Where does yield in crypto come from?

The interest rate on a savings account (India) is 2.5-3%. The same in US is 0.1-0.2%.

But then, crypto enters the room with yields ranging from 3-100(+)%.

Today, you can create a fixed deposit with yields above 12% in Bitbns, Vauld etc. Notice the clever framing of these financial assets as fixed deposits. To an average Joe, fixed deposit represents risk-free returns and associating this with crypto-yields is misleading.

But it begs the question how are these platforms able to offer such high returns when the cost of capital is relatively quite cheap? Let’s try to unravel what’s happening here.

Financial Wizardry

Protocols like Ribbon allow anyone to invest in complex financial products. The protocol will use your tokens as collateral to write call/put options. The yield offered can be anywhere between 17-30%. It is important to note that the call options will underperform (compared to HODL) if the token price goes to the moon. One can execute the same strategy in traditional stock markets, however, the crypto-markets are a lot more volatile which increases the premiums for writing options.

Importantly, in traditional stock markets, if you want to become an option-writer, you need to get involved in the process and learn about complex underwriting strategies. However, in crypto, you connect your wallet to the protocol, give them the permission to use your assets and they handle the rest of the complications, while you earn the yield.

Lending to the big whales

Crypto-markets are still at a nascent stage. In comparison, traditional stock markets have been around for more than 2 centuries. Advanced market-makers and high frequency trading firms have eliminated most of the inefficiencies in the stock market. But, the same is not true for crypto. Arbitrage exists across multiple exchanges. Remember, Sam Bankman’s (FTX founder) famous Japanese arb-trade where his firm made 10% return EVERY SINGLE DAY. These market-neutral strategies have no directional exposure to cryptocurrencies, which simply means that the markets can up or down, but these strategies will still make money. So, hedge funds and traders have two options: use their own capital or use leverage to increase their positions. Given the risk-free nature of these trades (relatively), they prefer the latter. But, a Goldman Sachs or BoA isn’t going to lend them against their crypto-holdings, so whose doors do they knock.

Let’s hear from the CEO of BlockFi.

“We’re the largest lender of cryptocurrencies to institutional borrowers, who today are primarily market makers and proprietary trading firms that are active in this asset class and have been for a while, but they can’t finance that activity with their traditional prime broker relationships because banks aren’t active in the space yet,” he said. “That’s the reason why the yields are still high, because this is a new asset class. It’s nascent, it’s growing quickly, and it doesn’t have access to the traditional sources of debt capital. And as a result, when we’re lending, we’re able to charge higher rates, and then we pay that back to the folks who are our clients on the front end.”

Staking and Liquidity Pools

Now, let’s talk about the yield generated via different protocols. These yield sources do not have a counterpart in the traditional stock market.

Staking cryptocurrencies is a process that involves committing your crypto assets to support a blockchain network and confirm transactions. It’s available with cryptocurrencies that use the proof-of-stake model to process payments. For example, on ethereum network, you require 32 ETH to become a validator, but you can participate in staking pools by depositing any amount and start earning.

Another interesting aspect of crypto is decentralized exchanges which are automated market makers providing liquidity to different trading pairs (ETH/USDC, ETH/BTC etc). They do not use order books to determine asset prices like centralized exchanges (Coinbase, Binance). Instead, they maintain pools with atleast 2 crypto-currencies where the asset price is determined by the no of its tokens in the pool. For example, let’s consider a ETH/BTC pool. If no of ETH in the pool decreases, then the price for ETH will increase. This incentivizes traders to add ETH to the pool, thus, maintaining the balance. If you’re curious to know more, check out Uniswap’s whitepaper.

When you deposit cryptocurrencies to these pools, you earn a proportion of the transaction fees generated.

Rewards for early users

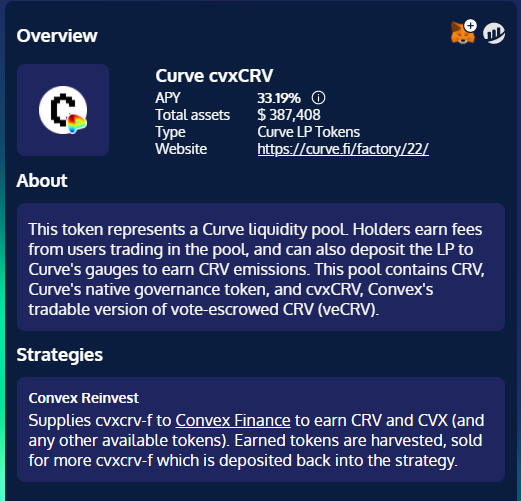

Now, this is the wild west of crypto. The yields here can go even higher than 100%. For example, the following vault by yearn.finance offers a ~33% APY at the time of the writing. If you can look at the breakdown, the majority of it is in the form of rewards from protocols trying to attract early users. A parallel to this can be a web2 company providing better cashbacks to entire the first 1000 users. However, the key difference is that web3 companies are offering tokens which can grow in value (or go to zero) and these token holders have governance rights, implying that they can vote on several key proposals affecting the protocol.

The most notable example of such rewards is Uniswap’s 400 UNI airdrop last year. Every wallet that had even tried to use Uniswap since its inception could claim 400 UNI, worth well over 1000$ at the time. That’s generous by any measure.

It makes sense to offer rewards to early users to bootstrap the network, but as the protocol grows in scale, these rewards will come down and the yields will start to reflect the real earnings.

Conclusion

Crypto yields are insanely high today. Platforms like Vauld, BitBns, Flint are trying to capture this trend by offering a simplified user experience to invest in high-yield earning protocols. It is non-trivial even for crypto enthusiasts to directly interact with these protocols and therefore, centralized platforms emerge as the gateway for the majority of the world population to interact with the crypto ecosystem. There are two things I am looking forward to in this space:

- As crypto-markets mature, we will see yields on cryptocurrencies come down. Although, the yields should still be higher than traditional finance companies due to lack of intermediaries in the crypto-ecosystem.

- Currently, it’s easier to sign-up on Vauld and start earning yield on your holdings. But, these centralized platforms take a cut of their own. As of now, Vauld doesn’t have any token and is a centralized company with complete authority on its take rate. At what point does this lack of transparency or ownership start to trump the convenience of UX or can decentralized platforms evolve quickly (and cheaply) to offer the same intuitive experience to users. This will be an interesting space to watch.